On Wednesday, the Federal Reserve cut interest rates by half a percentage point—the first rate cut in four years and the largest in 16 years. This bold move marks the start of a new easing cycle, with further cuts projected by year-end.

As a result, gold, a traditional safe-haven asset, has surged to fresh record highs, climbing beyond the USD 2,600 mark. With global economic uncertainty and geopolitical risks mounting, could gold be on track to reach the USD 3,000 mark?

The Inverse Relationship Between Gold and Interest Rates

Historically, gold and interest rates have an inverse relationship. When the Fed reduces rates, the opportunity cost of holding gold—which yields no interest—decreases, making it more attractive to investors. Lower rates also tend to weaken the U.S. dollar, further boosting gold’s appeal. As the Fed continues to lower borrowing costs, demand for gold as a store of value has surged, particularly as concerns over a global economic slowdown and potential recession grow.

Gold Hits Fresh Record Highs

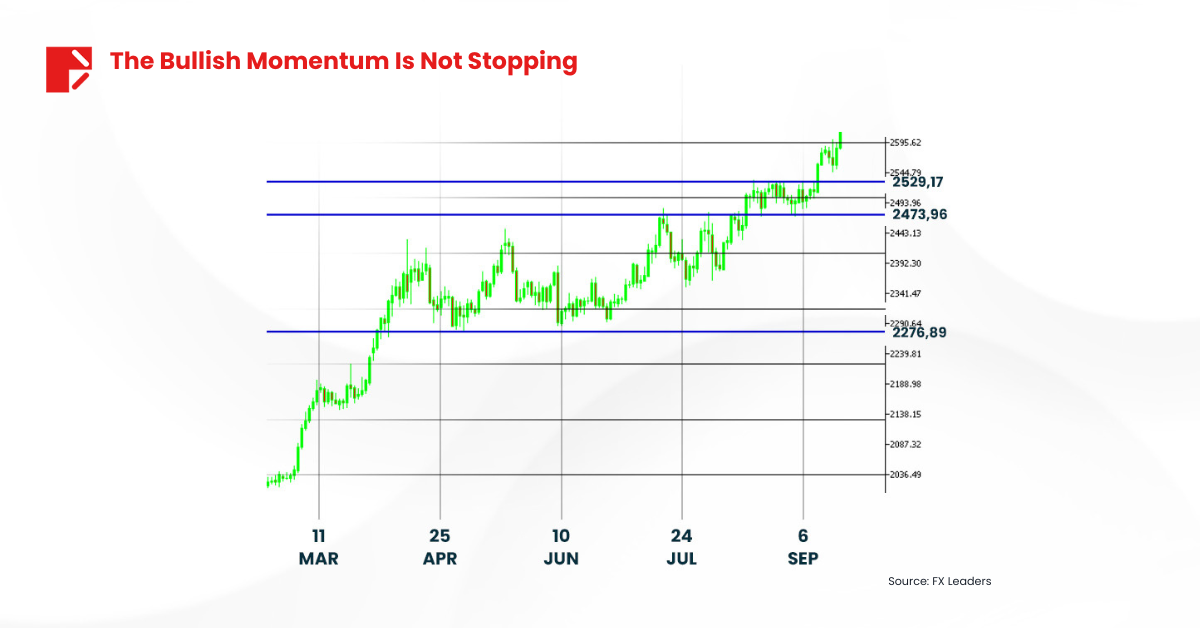

Gold prices continued their rally following the Fed’s significant rate cut, with bullion reaching a record high of USD 2,599.92 on Wednesday. By Friday, spot gold was trading near USD 2,593.79 per ounce, up about 0.7% for the week. U.S. gold futures also edged higher, up 0.2%, reaching USD 2,618.70. The expectation of further Fed rate cuts, coupled with a weakening U.S. dollar, has been a major factor fueling this bullish momentum.

Kyle Rodda, a financial market analyst, highlighted the positive outlook for gold, stating that “current trends are very favorable for gold, and if these market conditions persist, prices could rise to between USD 2,600 and USD 2,800 over the next 12 months.”

Historical Rate Cuts and Gold Rallies: What Could Happen Next?

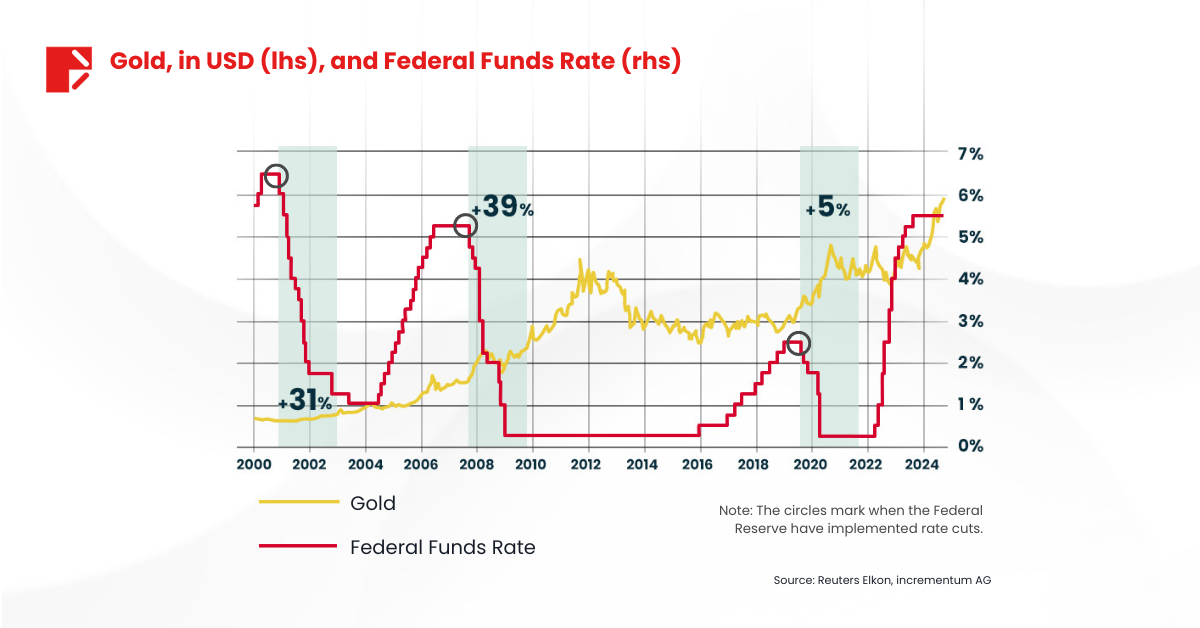

Gold has a strong track record of rallying during Federal Reserve rate cut cycles. In early 2000, gold surged by 31% following a series of rate cuts. Similarly, during the 2008 financial crisis, gold rallied by 39% as the Fed slashed interest rates to support the economy. More recently, in 2020, gold gained 5% as the Fed responded to the pandemic-driven economic downturn with aggressive rate cuts.

These historical trends highlight how gold tends to perform strongly in periods of monetary easing. With the Fed now embarking on another easing cycle and projecting further rate cuts into 2025 and 2026, many investors are wondering: How much higher can gold go this time?

Given the current global uncertainties, the possibility of further rate reductions, and rising geopolitical risks, some analysts believe that gold could reach USD 3,000 or beyond in the coming months. While past performance isn’t always an indicator of future results, history suggests that gold’s upward momentum could be far from over.

Global Central Bank Easing Fuels Gold Demand

The Federal Reserve’s rate cut has set the stage for further easing globally, with several central banks following suit. For example, the European Central Bank (ECB) reduced its interest rates by 25 basis points and the Philippines recently reduced its interest rates by 250 basis points, contributing to the overall strength in gold prices. Lower global interest rates are reducing the appeal of government bonds, leading investors to seek out alternative safe assets like gold.

The Fed also projected a further 50 basis point reduction in borrowing costs by the end of the year, with additional cuts expected in 2025 and 2026. This extended period of monetary easing is expected to keep downward pressure on the U.S. dollar and support gold prices.

Geopolitical Risks and Economic Concerns Boost Safe-Haven Appeal

Persistent concerns over the economic outlook of both the U.S. and China—the world’s two largest economies—have amplified demand for gold. The U.S. economy, despite strong job data, faces uncertainties about future growth prospects, while China continues to grapple with slowing industrial production and rising debt levels.

Geopolitical risks also remain elevated. In the Middle East, Israeli airstrikes on southern Lebanon have intensified, escalating tensions in the region. At the same time, the Russia-Ukraine conflict continues to create uncertainty in global markets. Gold, as a hedge against geopolitical instability, has benefited from these developments.

Moreover, with the U.S. presidential election approaching, political uncertainty is adding another layer of support for gold. Safe-haven demand is likely to remain strong as investors navigate these uncertainties.

Rising Physical Demand for Gold

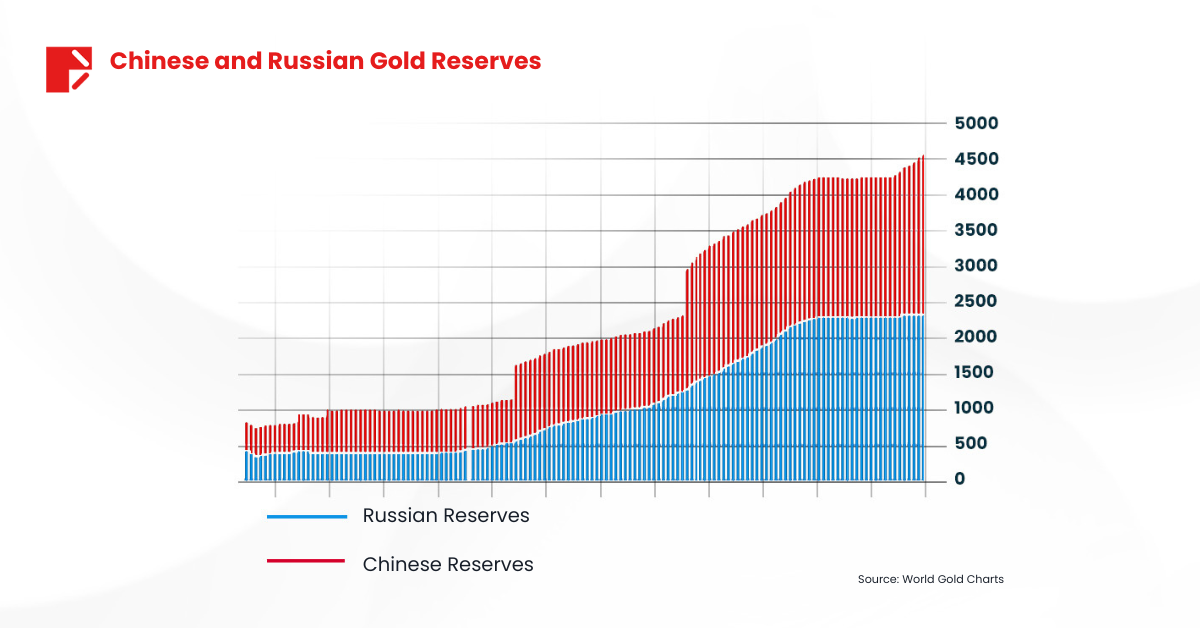

In addition to monetary policy and geopolitical factors, physical demand for gold has risen sharply. Central banks in Asia and Russia are increasing their gold reserves as they look to diversify away from the U.S. dollar. Poland’s central bank recently boosted its gold holdings, while India’s gold imports surged to record levels after a tariff reduction on gold jewelry and bars.

However, China’s decision to refrain from importing gold from Switzerland in August—marking the first time since January 2021—has raised questions about future demand trends. Despite this, the overall demand for physical gold remains robust as investors continue to seek safety.

Gold’s Path to $3000

With gold prices already above USD 2,600, the prospect of reaching USD 3,000 is becoming increasingly realistic. The Fed’s forecast for further rate cuts, combined with geopolitical risks and global economic uncertainty, creates a favorable environment for gold to climb even higher. The current technical outlook shows gold nearing resistance at the USD 2,610- USD 2,615 level. If this barrier is broken, it could pave the way for a further rise toward USD 2,800 or beyond.

However, the USD 2,550- USD 2,530 region remains a key support level, and a break below this could signal a near-term correction. Some analysts caution that a temporary pullback is possible, but the broader trend remains bullish as long as the fundamental drivers—such as low interest rates and geopolitical risks—persist.

Stock Markets Rally, But Gold Stands Strong

While gold continues to rally, the stock market has also benefited from the Fed’s rate cut. The S&P 500 hit record highs this week, reflecting renewed investor confidence in the Fed’s policy direction. Despite the bullish momentum in stocks, gold remains a key safe-haven asset, providing a hedge against potential economic slowdowns or geopolitical shocks.

The Federal Reserve’s largest rate cut in 16 years has set the stage for a continued surge in gold prices. With gold climbing beyond USD 2,600 and further Fed rate cuts on the horizon, the precious metal is well-positioned to rise even higher.

Geopolitical risks, global economic concerns, and rising physical demand continue to support gold’s upward trajectory. While short-term resistance levels may slow the rally, the possibility of gold reaching USD 3,000 is no longer out of reach, making it a crucial asset for investors navigating today’s uncertain landscape.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.