Reflecting on 2024 is the first step to planning for 2025. At the year’s start, the biggest focus was on when the Fed would begin cutting interest rates. After 12 months of ups and downs, the Fed has initiated its rate-cutting cycle, and the attention now shifts to the extent of rate cuts in 2025 and the policy direction of Donald Trump, who will officially take office as U.S. President on January 20.

As we bid farewell to 2024, this article explores the top 10 economic events that defined the year. From central bank moves to market highs and political developments, these pivotal moments offer valuable insights to help investors refine their trading strategies for the year ahead.

1- Bank of Japan’s Surprise Rate Hike

In July 2024, the Bank of Japan unexpectedly raised its benchmark rate from 0%-0.1% to 0.25%, its second hike this year, triggering a yen carry trade unwinding. This caused Japan’s Nikkei index to crash over 12% on August 5, dubbed “Black Monday.”

2025 Outlook:

With Japan’s real interest rates still low, Governor Kazuo Ueda signaled that if economic conditions align, further rate hikes may occur in 2025, drawing significant market attention.

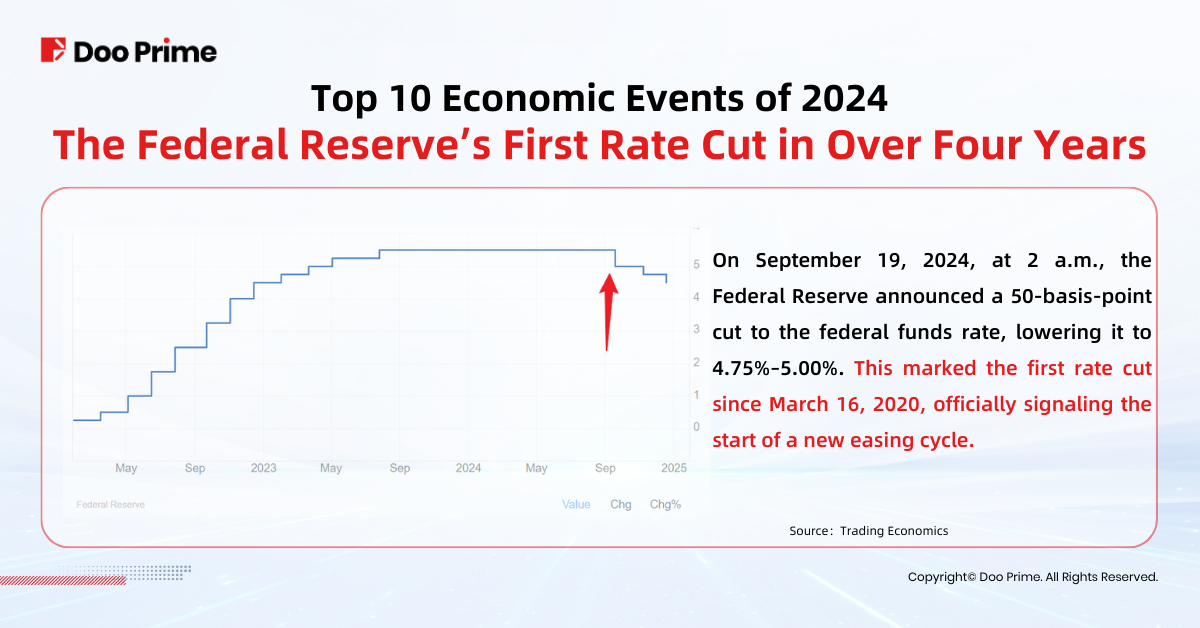

2- The Fed’s First Rate Cut in Over Four Years

In September, the Federal Reserve cut interest rates by 50 basis points—the first since March 2020—ushering in an easing cycle and boosting market optimism.

2025 Outlook:

Fed officials expect only two rate cuts in 2025, a reduction from earlier projections, assuming steady economic growth and declining inflation.

3- Trump Re-Elected as U.S. President

On November 6, Donald Trump defeated Kamala Harris, claiming victory with promises of a “Golden Age for America.” Markets soared, with the U.S. dollar index up 1.69% and all three major stock indices hitting record highs.

2025 Outlook:

Focus shifts to Trump’s cabinet and policies, including anti-immigration, tax cuts, and higher import tariffs, which may spur inflation.

4- S&P 500 Hits 57 All-Time Highs in 2024

The U.S. bull market continued, with the S&P 500 up 27.34% YTD by December 16, achieving 57 record highs. Nasdaq surged 34.39%, crossing 20,000 points, while the Dow climbed 15.99%, breaking 6,000 points.

2025 Outlook:

Analysts expect the S&P 500 to aim for 6,600 points in 2025, with tech stocks remaining a key driver, though gains might narrow across sectors.

5- Gold Prices Reach New Highs

On October 30, gold futures hit a historic $2,801.65 per ounce, and spot prices topped $2,790. Global gold demand exceeded $100 billion in Q3 2024, another record.

2025 Outlook:

Goldman Sachs forecasts gold prices to reach $3,000/oz by December 2025, driven by economic uncertainties.

6- AI Stocks Shine Bright

AI-related sectors flourished in 2024, with SoundHound AI (+820%), Applovin (+763%), Palantir (+341%), and Nvidia (+166.55%) leading the charge.

2025 Outlook:

Bank of America projects continued growth in chip stocks, a key force behind the bull market since 2023, potentially fueling another “super bull” run.

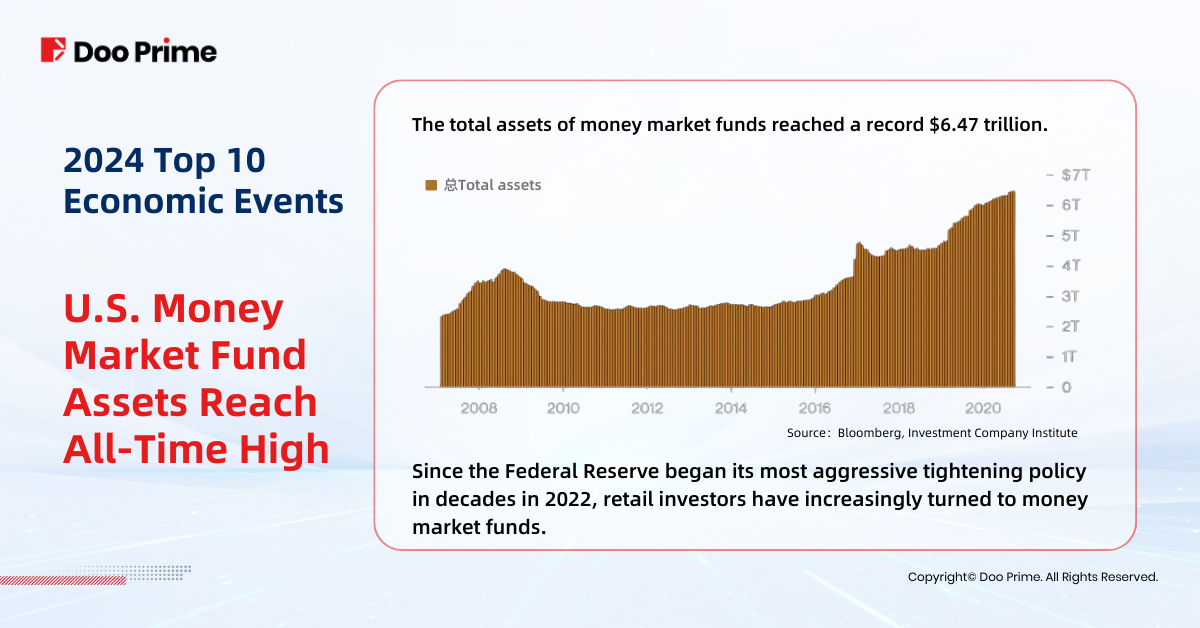

7- U.S. Money Market Funds Hit Record Size

By October, U.S. money market fund assets reached a record $6.47 trillion, despite the Fed’s September rate cut. High yields kept attracting inflows.

2025 Outlook:

With declining rates, funds may shift toward equities, depending on the economic environment and pace of rate cuts.

8- Global Government Debt Hits Record High

Global government debt reached $91.4 trillion by Q1 2024, a 5.8% YoY increase, driven by election-related fiscal policies.

2025 Outlook:

Economists warn that debt reduction will likely weigh on global economic growth.

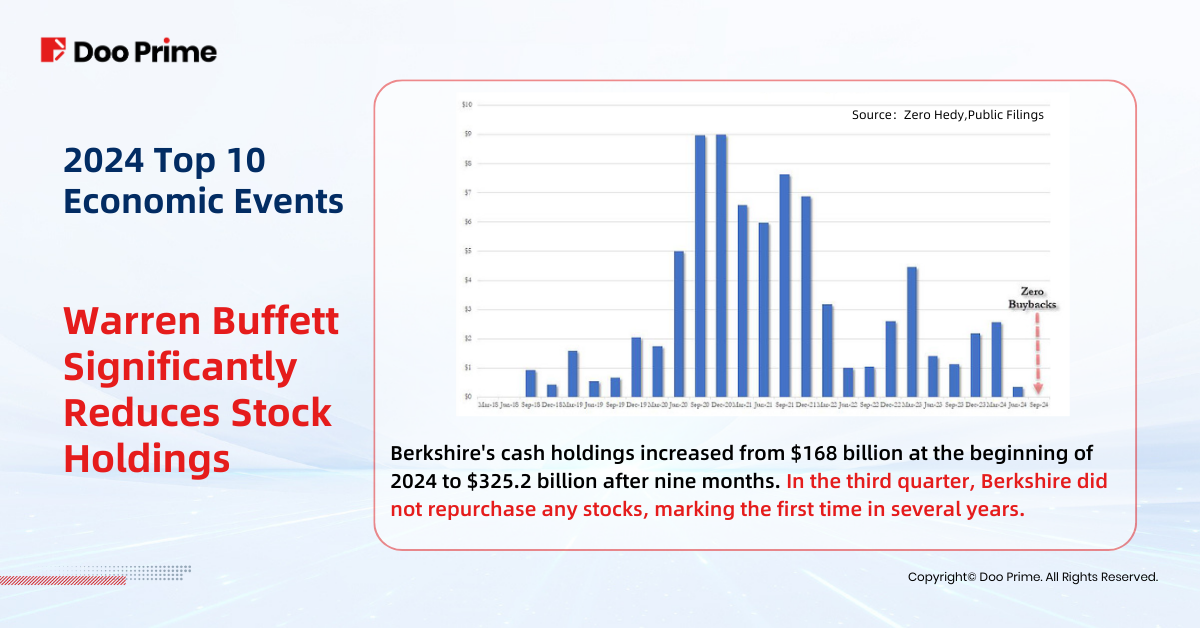

9- Warren Buffett’s Stock Sell-Off

Berkshire Hathaway’s cash reserves soared to $325.2 billion by Q3 2024 as Buffett reduced Apple holdings by two-thirds.

2025 Outlook:

Buffett’s moves suggest concerns over overvalued stocks, signaling caution for 2025.

10- Hang Seng Index’s Remarkable Rebound

In September, the Hang Seng Index surged from below 17,000 to 23,000 points, driven by Fed rate cuts and China’s easing measures.

2025 Outlook:

The index’s trajectory will depend on China’s fiscal policies and economic recovery.

Top 10 Economic Events: Opportunities Amid Challenges

While 2024 brought challenges, 2025 holds the promise of a “soft landing” for the global economy. For investors, every crisis presents an opportunity. By managing risks carefully and staying attuned to macroeconomic trends, investors can seize the best opportunities in the new year.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.