On January 16, Blue Origin is set to launch its first New Glenn rocket into orbit. This event marks a significant milestone, not just for Jeff Bezos in his race against Elon Musk, but also for investors exploring opportunities in the burgeoning space economy.

The space industry, once distant for individual investors, is now emerging as a $1.8 trillion opportunity by 2035. Are you ready to seize the moment?

This article will analyze Blue Origin’s historic event, its impact on the space industry, and reveal potential investment strategies.

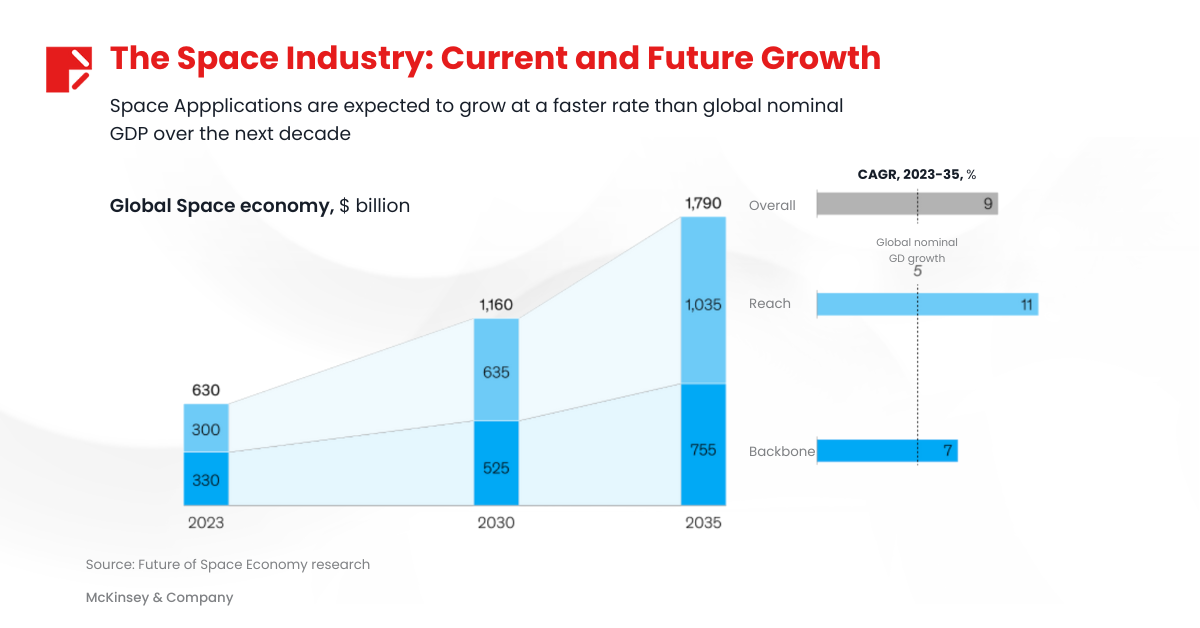

The Space Industry: Current and Future Growth

The report “Space: The $1.8 Trillion Opportunity for Global Economic Growth” by McKinsey & Company will be a crucial source of data for us to gain the most detailed insight into this industry.

According to the report, the global space economy is expected to reach a value of approximately $1.8 trillion by 2035, up from just $630 billion in 2023. The annual growth rate is projected to be 9%, which is higher than the global GDP growth rate.

This valuation includes the valuation of both “backbone” and “reach” applications of the space industry.

Two Main Applications in Space Technology

- “Backbone” Applications: Core technologies like satellites, rockets, and GPS. Expected to grow 7% annually until 2035.

- “Reach” Applications: Technologies impacting terrestrial industries such as defense, logistics, and digital communications. Growing faster at 11% annually.

4 Key Growth Drivers

- Lower Costs: Satellite launches increased by 50% from 2019 to 2023, while launch costs dropped 10x over the past 20 years.

- Technological Advancements: Innovations like reusable rockets enhance profitability.

- Diverse Investments: Private investments in the space sector peaked at over $70 billion in 2021 and 2022.

- Human Ambition: Plans for Mars colonization and space resource extraction drive development.

In summary, the space economy is an incredibly exciting field, with growth expectations aligned with humanity’s ambitions to dominate space. Therefore, major players like Blue Origin and SpaceX will be key enterprises, both contributing to and benefiting from this development.

However, to profit from activities beyond Earth, both Jeff Bezos and Elon Musk will have to strive to achieve new milestones.

Blue Origin vs. SpaceX: Competition and Collaboration

Jeff Bezos once stated, “The space industry is big enough for both Blue Origin and SpaceX.”

Visions and Objectives

- SpaceX:

- Aims to send humans to Mars, with over 100 successful launches in 2023, including its Starlink satellite network.

- Blue Origin:

- Focused on enabling millions to live and work in space, with suborbital tourism flights and the Amazon Kuiper satellite project.

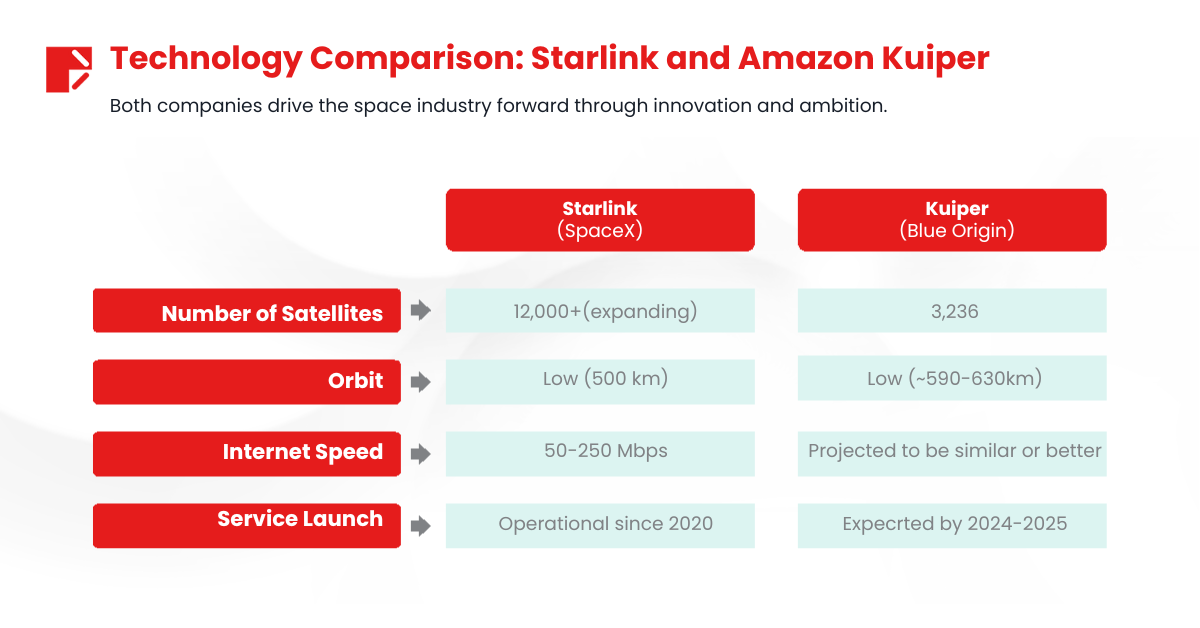

Technology Comparison: Starlink and Amazon Kuiper

Technologically, both focus on developing reusable launch rockets to minimize costs. This enables them to provide satellite internet services with low latency, affordable costs, and coverage everywhere without the need for physical wired infrastructure.

However, the core products from the two companies have distinct characteristics such as:

Flagship Rockets

- New Glenn (Blue Origin): 320 feet tall, payload capacity of 45 tons, supporting Kuiper.

- Falcon 9 (SpaceX): 230 feet tall, payload capacity of 23 tons, with hundreds of successful launches.

While competitive, both companies drive the space industry forward through innovation and ambition.

Understanding the industry and the current key players, the next important question is how we can seize opportunities in this unique field.

Investment Opportunities in the Space Sector

1. Alternative Stocks

Amazon (AMZN):

Owned by Jeff Bezos, Amazon is indirectly linked to the success of Blue Origin. Additionally, Amazon’s Kuiper project, which focuses on satellite internet, enhances its presence in the space sector.

Reason: Amazon has strong financial capabilities and is diversifying into space technology.

Rocket Lab USA (RKLB):

Companies like Rocket Lab USA launch satellites to improve mobile communication, support GPS positioning, and assist in emergency response. Satellites are becoming increasingly important globally, and Rocket Lab provides propulsion systems, satellite platforms, and launch vehicles.

Rocket Lab’s revenue increased by 55% year-over-year in Q3. Although its stock has been volatile since going public via SPAC in 2020, its value has quadrupled over the past year. Recently, Rocket Lab was selected by NASA for a groundbreaking mission to return samples from Mars to Earth.

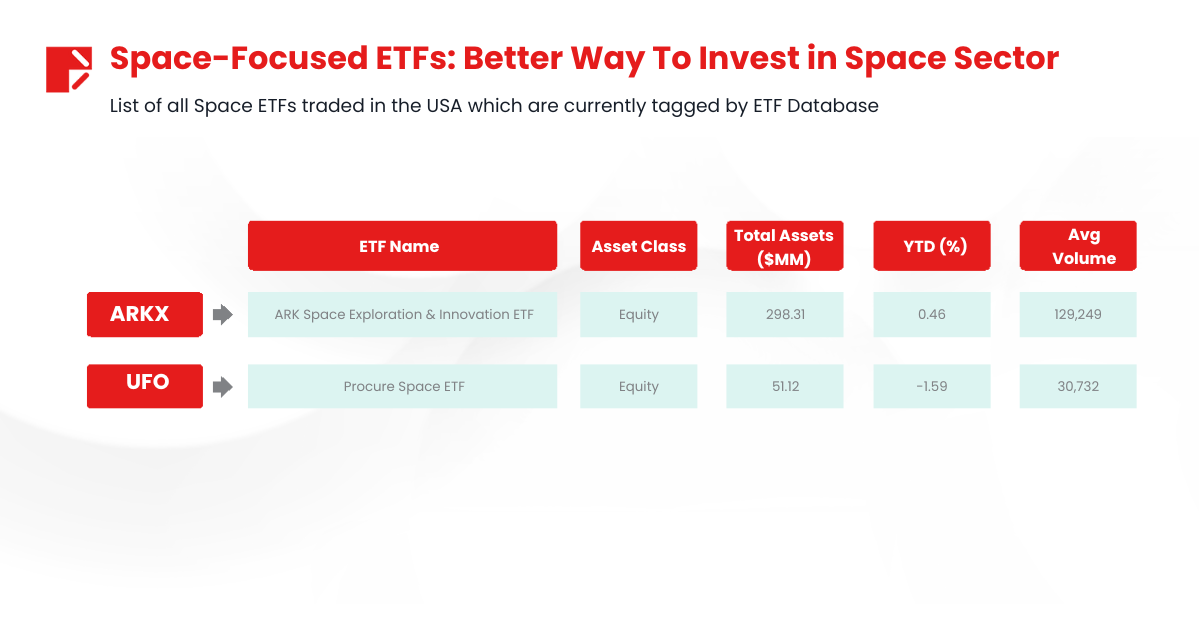

2. Space-Focused ETFs

ARK Space Exploration & Innovation ETF (ARKX):

The ARK Space Exploration & Innovation ETF focuses on stocks related to the space industry, avoiding companies with significant revenue from other sectors. The fund’s three largest investments are Rocket Lab, Kratos Defense & Security Solutions (KTOS), and Iridium Communications (IRDM), which together account for 27% of its total assets. Other notable holdings include AeroVironment (AVAV), Amazon (AMZN), and Palantir Technologies (PLTR).

Although its performance over the past three years has been modest, the fund delivered an impressive return of 30.6% in 2024. However, it is an actively managed ETF with a higher expense ratio of 0.75%.

Procure Space ETF (UFO):

Procure Space ETF takes a similar approach to ARKX, focusing on space stocks to provide “diversification beyond companies that only operate on Earth.” Although its five-year returns have not been impressive, the fund increased by 36.1% over the past 12 months (as of December 16), thanks to a 14% allocation to Rocket Lab.

The three largest investments of UFO are Rocket Lab, MDA Space Ltd. (MDA.TO), and Globalstar Inc. (GSAT), each accounting for 6% of the portfolio, totaling over 25% of the fund’s assets. With a relatively concentrated portfolio of 35 stocks, UFO has an expense ratio of 0.75%, but its impressive performance over the past year has significantly compensated for this.

Conclusion

The launch of Blue Origin’s New Glenn rocket demonstrates the limitless potential of the space industry. With rapid growth and major players like Blue Origin and SpaceX leading the way, opportunities for investment in this sector are increasingly evident.

However, the risks that can be mentioned may be the profitability issues of the companies. Simply put, jumping into an “out-of-this-world” game requires an investment capital “up to the sky.”

According to experts, the space sector will be the future of the entire economy, as it has the power to impact on the lives of every individual on Earth, and of course, every existing industry. Therefore, do not overlook any new advancements in the industry to avoid missing any future opportunities.

Follow Doo Prime to read more useful and interesting articles.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.